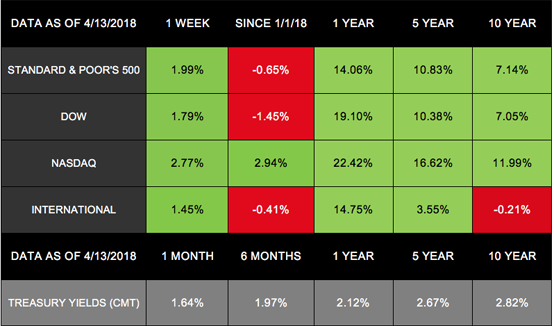

Market volatility continues. Stocks slid on Friday, April 13, but still held on to gains for the week.[1] The S&P 500 increased 1.99%, the Dow added 1.79%, and the NASDAQ was up 2.77%.[2] International stocks in the MSCI EAFE also rose, gaining 1.45%.[3]

Similar to recent weeks, international events continued to sway markets: Concerns about trade disputes affected investor behavior. Meanwhile, escalating conflict in Syria may have weighed on people’s minds.[4]

As we track these developments, we want to share insight about another important occurrence from last week: the beginning of corporate earnings season.

[dt_gap height=”10″ /]

1st Quarter Corporate Earnings Season

1. Expectations remain very high

Analysts anticipate a particularly strong earnings season. Thomson Reuters data predicts that S&P 500 companies’ profits were 18.6% higher in the 1stquarter of 2018 than in 2017. If accurate, this increase would be the largest since 2011.[5]

So far, data seems on track. According to The Earnings Scout, 1st-quarter earnings growth is currently at 26.8%.[6]

2. Banks outperform but stocks drop

On Friday, 3 major banks released their reports – and each beat projections for earnings and revenue. Despite this positive news, however, their stocks experienced sizable declines that contributed to overall market losses.

[dt_gap height=”10″ /]

Why would strong quarterly results create stocks losses?

[dt_gap height=”10″ /]

The markets anticipated this positive performance and had already priced it into the shares.[7] As a result, any less-than-ideal news seemed to outweigh the expected earnings and revenue increases. In particular, 2 facts drove losses:[8]

- 1 bank may have to pay a $1 billion penalty

- All 3 banks experienced slow loan growth

We are in the early stages of earnings season, and many major corporations still need to release their reports. In the coming weeks, we’ll continue monitoring these developments to better understand our economy. As always, please contact us if you have questions about how the data affects your finances and life.

[dt_divider style=”thick” /]

ECONOMIC CALENDAR

Monday: Retail Sales, Housing Market Index

Tuesday: Housing Starts, Industrial Production

Thursday: Jobless Claims

Notes: All index returns (except S&P 500) exclude reinvested dividends, and the 5-year and 10-year returns are annualized. The total returns for the S&P 500 assume reinvestment of dividends on the last day of the month. This may account for differences between the index returns published on Morningstar.com and the index returns published elsewhere. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

[dt_divider style=”thick” /]

[dt_gap height=”10″ /]

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Investment advisory services and insurance services are provided through Absolute Return Solutions Inc., a Registered Investment Advisor.

Any economic and/or performance information cited is historical and not indicative of future results. Absolute Return Solutions Inc. is an investment advisor registered in each state Absolute Return Solutions Inc. maintains client relationships.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative,

Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] www.cnbc.com/2018/04/13/us-stock-futures-dow-data-earnings-tech-and-politics-on-the-agenda.html

http://performance.morningstar.com/Performance/index-c/performance-return.action?t=@CCO

[3] www.msci.com/end-of-day-data-search

[4] www.cnbc.com/2018/04/13/us-stock-futures-dow-data-earnings-tech-and-politics-on-the-agenda.html

[6] www.cnbc.com/2018/04/13/us-stock-futures-dow-data-earnings-tech-and-politics-on-the-agenda.html

[7] www.cnbc.com/2018/04/13/us-stock-futures-dow-data-earnings-tech-and-politics-on-the-agenda.html

www.cnbc.com/2018/04/15/from-geopolitics-to-earnings-what-will-move-markets-most-ahead.html