[vc_row][vc_column][vc_column_text]

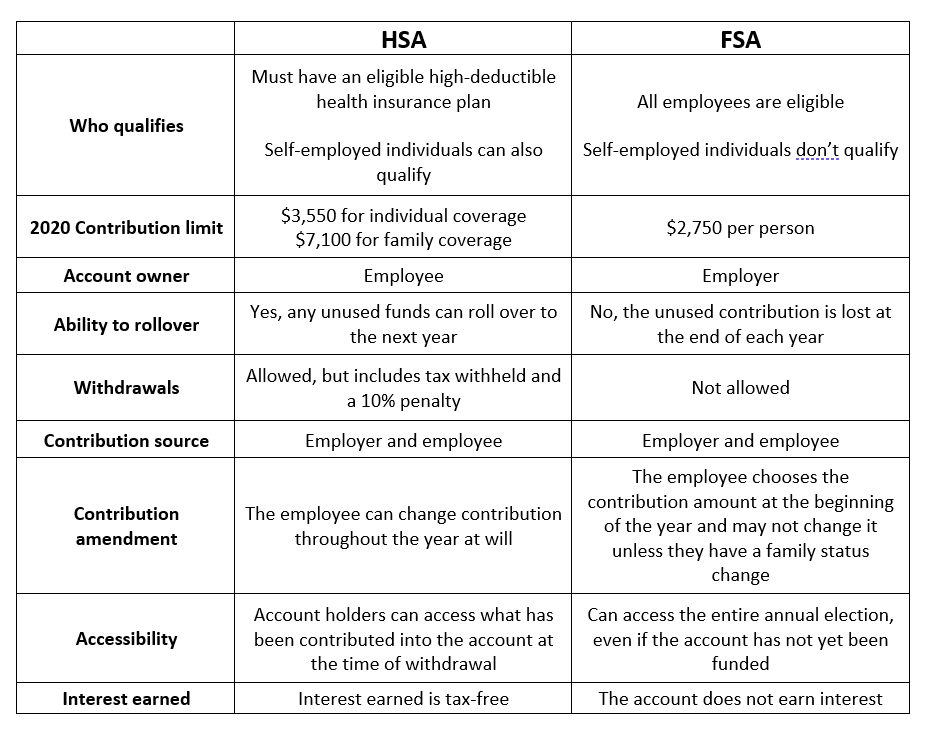

Even for the healthiest individuals, healthcare can be expensive. While your health insurance may cover some of the costs, you may want to consider opening a Health Savings Account (HSA) or Flexible Spending Account (FSA) to take advantage of some of the tax benefits that come with each. Both accounts are federal government programs designed to help pay for medical expenses that aren’t covered by insurance. So, HSA vs FSA, what’s the difference? To better understand the difference between the two accounts, here’s what you need to know.

What is an HSA account?

If you have a high-deductible insurance policy, either through your employer or have one as a self-employed individual, you may be able to open a Health Savings Account (HSA) in conjunction with your plan. With an HSA, you can set aside funds to pay for future qualified medical expenses on a pre-tax basis.

Using pre-tax dollars to pay for your deducible, copayments, coinsurance, or other medical expenses can potentially lower your health care costs. Keep in mind, you generally can’t pay for your premiums with your HSA account.

After you establish an account, employees can contribute via a payroll deduction from their gross income. You, your employer, or both can contribute to your account. Any interest or earnings in the account is also tax-free when you make a withdrawal to pay for a medical expense. But, watch out, because if you withdraw funds for any other reason than for qualifying medical expenses, you may get stuck with a hefty tax penalty if you’re under 65 years old.

One of the biggest advantages of an HSA account is that it’s portable. Even if you transition to a new job, you can keep the money you have already contributed. Additionally, at the end of each year, you can keep the money that you’ve contributed to your account. As of 2020, you can contribute up to $3,550 for individual coverage and $7,100 for family coverage.

What is an FSA account?

Like an HSA, you can use a Flexible Spending Account (FSA) to pay for your out-of-pocket medical expenses on a tax-free basis. Some expenses may include your copayments, deductibles, eligible prescriptions, insulin, and more. Unlike an HSA, you must open an account through your employer. You cannot be self-employed and have an FSA.

At the beginning of the year, you must determine how much you want to contribute toward your account. You, your employer, or both can contribute to your account. Your employer can deduct your contributions from your gross pay every pay period which makes them tax-free. You’re unable to make any changes to this amount unless there is a change to your employer or family status. These stipulations are specified by your plan.

FSAs are “use it or lose it” accounts. This means that if you have money left in your FSA at the end of the year, you will forfeit any remaining balance. However, some employers can allow for either a 2.5-month grace period or let you carry over up to $500.

How to determine the best fit for your needs

Now that you understand the basics, it’s important to determine which account is more suitable for your needs. Since everyone has a different financial situation, they may require a different recommendation. The following are some things that you should consider when deciding between an HSA and an FSA.

Flexibility

For those who are looking for flexibility, portability, and tax-free growth, an HSA might be a better fit. For example, if you think you might want to switch jobs soon, an HSA will allow you to keep the funds in your account. With an FSA, you can’t move funds or roll them over into the next year.

Interest and tax-free growth

Unlike FSAs, HSAs allow account holders to use the account for long-term investment growth. While you may want to keep some of your accounts in cash for emergency medical costs, you can invest the rest for growth.

Emergency savings

Although HSAs provide more flexibility, portability, and tax-free growth, you must enroll in a high-deductible health for eligibility. High-deductible plans come with high out-of-pocket medical costs and deductibles. Usually, high-deductible plans are a good fit for young and healthy people who have a robust cash flow and solid emergency savings.

If you see the doctor often, have higher medical bills or need to stay in a certain health insurance network to see a specific medical professional, a high deductible plan might not be in the cards for you.

HSA vs FSA: Which one is right for you?

Now that you understand the difference between an HSA and an FSA, you can make a well-informed decision. For those who can’t afford a high-deductible insurance plan but have a good amount of medical bills, an FSA might be your best option. On the other hand, if you’re young and healthy, can afford a high-deductible insurance plan, and want to capitalize on long-term growth, an HSA might be best.

The bottom line

So, HSA vs FSA, which one is right for you? If you need further guidance choosing the best option, you may want to consult with a financial professional. A financial planner that understands your financial situation can help you determine the best solution.

If you have further questions about your retirement or other financial questions, be sure to reach out to us . We are here to assist you in increasing your odds of retirement success.

DA-001601.1

[/vc_column_text][/vc_column][/vc_row]