Are You Prepared For Retirement?

Services

Learn What We Can Do For You

Retirement Income Management

By monitoring your income needs and your retirement spending plan, The Retirement Solution (TRS) helps you to spend well and live better in retirement. Beyond cash flow, there are also careful tax considerations that need to be made since income from different sources could be taxed differently. We take all of these considerations into account so you can simply make your monthly deposit and help live the life you’ve always dreamed of!

Portfolio Management

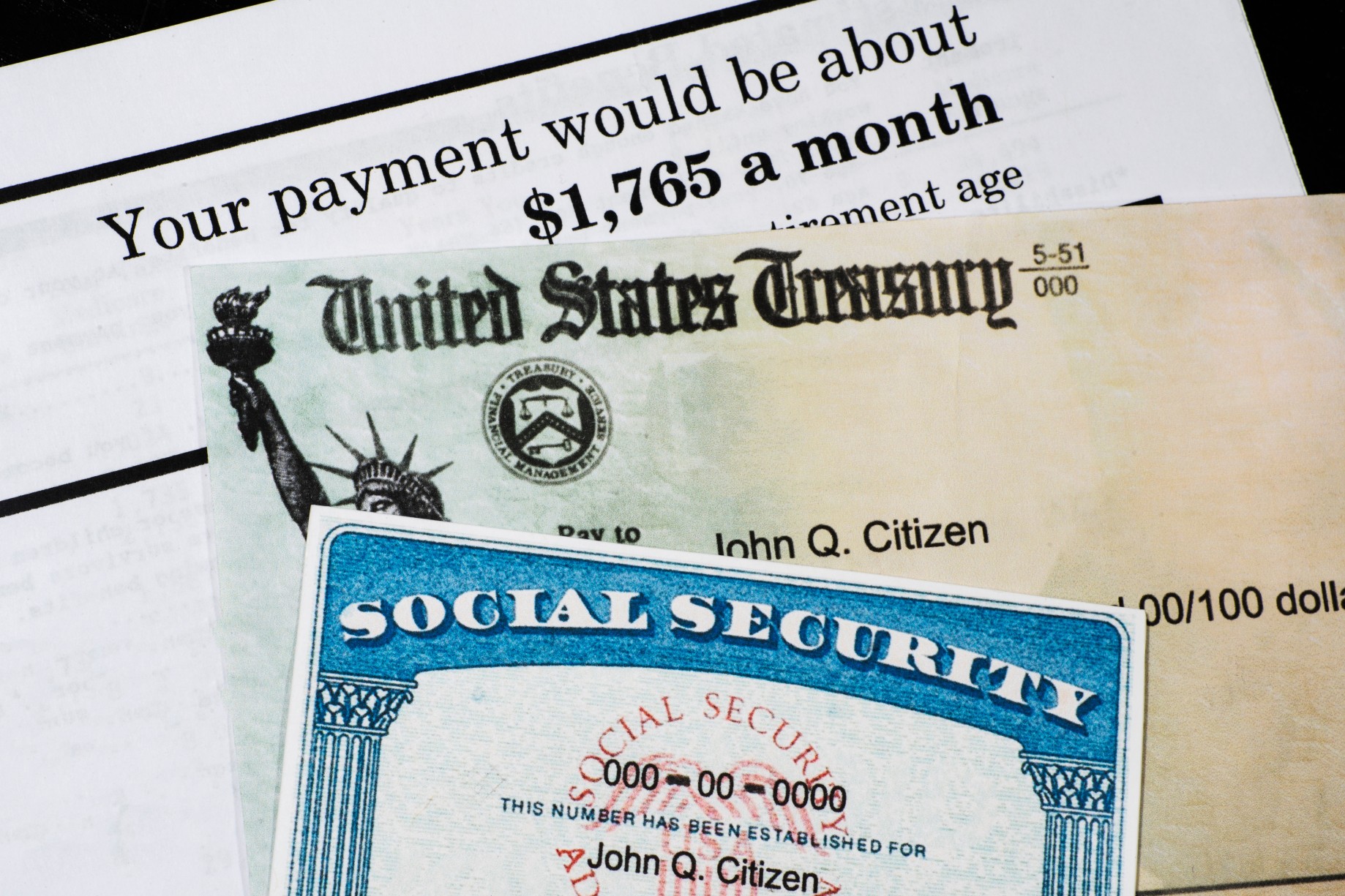

Social Security Planning

It’s important to know how integrating Social Security benefits into your retirement income plan can play a role in your overall financial strategy. Deciding to take Social Security as soon as you’re eligible or delaying the benefits can have a profound impact on both your income and your spouse’s. At TRS, we can help determine the optimal time to take your Social Security so you aren’t potentially leaving money on the table.

Medicare Planning

Pensions

It may seem simple enough to turn on your pension in retirement. However, you’ll still likely have a choice to make: Do you want to take the pension as a series of payments over your lifetime or as a single lump sum? Your decision can have huge implications for your retirement plan when it comes to asset allocation, tax planning and more. Working with a financial planner to determine the best option for your pension distribution in retirement means you’re in control of how your assets work for you.

Required Minimum Distributions (RMDs)

Once you reach age 73, you’re required to begin taking annual distributions from your traditional IRA or employer-sponsored plan (such as a 401(k) or 403(b)). For the few years leading up to your required annual distribution age, you’re able to take advantage of the tax benefits associated with these retirement accounts. However, Uncle Sam eventually wants his piece of the pie. When you reach the minimum distribution age, he gets his portion through taxes on those withdrawals. Planning out when and how to take required distributions may save you quite a bit on taxes over your lifetime.

Legacy and Estate Planning

When you pass away, what do you want to leave behind? What sort of impact do you want your estate to have? You can plan to spend all your assets, set some aside for charity, leave money to your kids or do all of these things. The choice is yours! With careful planning, your funds can be directed where you want them to go. And that planning can also help mitigate taxes, leaving more assets for your heirs to use and enjoy. From setting up a trust, choosing a life insurance policy or doing more advanced tax planning, we can help you leave the legacy you’ve envisioned.

Tax Optimization

We’ve all heard the saying about “death and taxes.” What we haven’t heard is the myriad of options available to potentially lessen your tax burden. Your decisions in the beginning of retirement can have a massive impact on the taxes you pay throughout your later years. Careful tax planning can save you thousands of dollars over your lifetime. For example, should you spend your IRA first or wait until later? When should you prioritize Roth money? What do you need to do TODAY to pay less in taxes 10 years from now? These are complex questions that require strategic planning and the ability to adapt to changing laws and circumstances. As part of monitoring your plan, TRS is always looking for the most efficient ways to lower your tax burden.

Survivors’ Assistance

Losing a loved one is one of the most painful experiences for people to go through. When that day comes, we’re often one of the first calls clients make. We’re here to listen and support you. We’ll also handle the details of account ownership changes, retirement plan updates, Social Security notices and other paperwork-related tasks. We’ve been through this process many times before and know the questions you may have as you navigate this difficult experience. Our team will be available with a ready-made list of the items to tackle, both immediately and down the road.

Annual Reviews

We are constantly monitoring your plan and making sure it is still working for you. At least once a year, we will proactively schedule a time to review how your financial plan is working in retirement. If there are any changes to the plan or your goals, we will always be there to make recommendations for adjustments. We’re here to keep you on track, so you can worry less about money in retirement.

Educational Events

There are many pitfalls that could derail your retirement. You can either look for them beforehand — or run into them along the way. Simply knowing about these pitfalls is half the battle. At TRS, we continuously provide educational opportunities to empower you to make the best financial decisions for you and your family. We do this by hosting regular seminars for our clients. Event topics include pertinent information regarding the different stages of retirement, so our clients can truly own their retirement plans.

SCHEDULE A FREE CONSULTATION

Providing for family, spending time with grandkids, traveling. You shouldn’t be wasting your golden years worrying about electric bills or the balance of your checking account. We’ve helped hundreds of people retire confidently and we can’t wait to do the same for you.

Our Locations

REDMOND, WASHINGTON

MILL CREEK, WASHINGTON

ENGLEWOOD, COLORADO

KENNEWICK, WASHINGTON