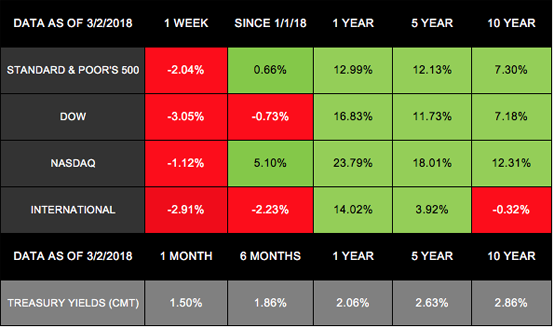

Volatility continued last week as markets posted their 1st weekly loss in 3 weeks.[1] Despite some recovery on Friday, the S&P 500 dropped 2.04%, the NASDAQ slipped 1.12%, and the Dow lost 3.05% for the week.[2] Internationally, the MSCI EAFE fell 2.91%.[3]

Last week’s ups and downs began with continued questions over whether the Fed will raise interest rates. By the week’s end, however, rumors of an international trade war dominated the attention of investors.

Fed Suggests Raising Interest Rates

New Fed Chair Jerome Powell testified on Tuesday that inflation and a strong economy may lead to interest rate hikes sooner than expected.[4] Whether the Fed will impose a 4th hike this year caused investor uncertainty and led to mid-week market drops.[5] Powell noted, however, that increased market volatility will not influence the Fed’s decisions regarding rate increases.[6]

Trump Announces Tariffs on Imports

Investor attention shifted on Thursday as President Trump announced plans to impose a 25% tariff on steel and a 10% tariff on aluminum imports.[7] While the move could protect American metal workers, some analysts worry it may also trigger a possible trade war.[8]

Countries around the world reacted to the news, with some announcing their own plans for U.S. tariffs in response.[9] Over the weekend, the President reacted by noting possible tariffs on imported autos, where the U.S. has a deficit. Some analysts worry this could further hurt an already negative trade gap in our Gross Domestic Product (GDP).[10]

Signs of Strength

Despite the developments with tariffs and rising interest rates, we did receive encouraging economic reports:

- Strong Consumer Sentiment: Last month’s consumer sentiment report hit its 2nd highest recording in over 10 years. Upon the approved tax bill, companies gave nearly $30 billion in bonuses, boosting consumer incomes and attitudes.[11]

- Outstanding Jobless Claims: Last week’s reported jobless claims were the lowest in 49 years. A healthy demand for labor and few layoffs have helped keep unemployment numbers low.[12]

What’s ahead?

Expect more market volatility going forward as investors follow the Fed’s interest rate plans to keep potential inflation in check. The President has also promised to announce specific details concerning the proposed new tariffs this week.[13] If you have questions concerning how these developing economic policies may impact your financial life, we are always here to help.[dt_gap height=”10″ /]

ECONOMIC CALENDAR

Monday: ISM Non-mfg Index

Tuesday: Factory Orders

Wednesday: ADP Employment Report

Thursday: Jobless Claims[dt_divider style=”thick” /]

Notes: All index returns (except S&P 500) exclude reinvested dividends, and the 5-year and 10-year returns are annualized. The total returns for the S&P 500 assume reinvestment of dividends on the last day of the month. This may account for differences between the index returns published on Morningstar.com and the index returns published elsewhere. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.[dt_divider style=”thick” /]

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Investment advisory services and insurance services are provided through The Retirement Solution Inc., a Registered Investment Advisor.

Any economic and/or performance information cited is historical and not indicative of future results. The Retirement Solution Inc. is an investment advisor registered in each state The Retirement Solution Inc. maintains client relationships.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] www.cnbc.com/2018/03/02/us-stock-futures-dow-data-earnings-fed-and-politics-on-the-agenda.html

http://performance.morningstar.com/Performance/index-c/performance-return.action?t=@CCO

[3] www.msci.com/end-of-day-data-search

[5] www.usatoday.com/story/money/markets/2018/02/28/fed-chiefs-rate-talk-puts-stocks-bind/378755002/

[6] www.cnbc.com/2018/02/27/fed-chairman-powell-market-volatility-wont-stop-more-rate-hikes.html

[8] www.cnbc.com/2018/03/01/forex-markets-focus-on-dollar-moves-after-trump-tariff-decision.html

[10] www.bloomberg.com/news/articles/2018-03-02/trump-opens-door-to-trade-war-as-eu-threatens-iconic-u-s-brands

[12] wsj-us.econoday.com/byshoweventfull.asp?fid=485207&cust=wsj-us&year=2018&lid=0&prev=/byweek.asp#top