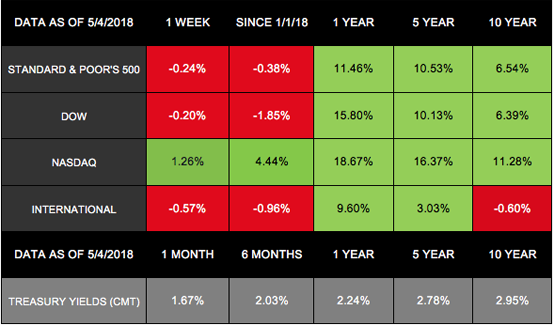

Domestic indexes posted strong results on Friday, May 4, as the latest labor report data lessened investors’ concerns about inflation and interest rates. Nonetheless, stocks had mixed results last week.[1] The S&P 500 dropped 0.24% and the Dow gave back 0.20%, which marked both indexes’ 2nd week of losses in a row.[2] Thanks to a bounce in tech stocks, however, the NASDAQ gained 1.26%.[3] International stocks in the MSCI EAFE decreased by 0.57%.[4]

Amid this relatively tepid performance, we reached a big milestone on May 1: Our current economic expansion is now officially the 2nd longest on record. For 8 years and 10 months, the economy has been growing, and many sectors still have room to advance.[5]

As we look to better understand where we stand today, Friday’s employment report provides key insights into our economic health.

What We Learned About Employment

1. Growth Slowed

The report indicated that the economy added fewer jobs than expected in April, and average hourly wage growth also grew more slowly than forecast. Federal Reserve members watch this data closely to help anticipate changes in inflation.[6]

2. Participation Dropped

The percentage of working-age people participating in the labor force dropped by 0.1%.[7] This decline may result from people retiring or returning to school but can also come from people choosing to stop looking for work. The lower participation rate may contradict some of the more positive trends we’ve seen recently.[8]

3. Unemployment Declined

Despite missing growth projections, unemployment fell to 3.9%, the lowest point in 18 years.[9] The rate has only dropped below 4% during 3 other periods.[10] The low unemployment numbers came more from the lower labor force participation rate than from more people finding jobs.[11]

Key Takeaway

Lower participation rates could affect long-term economic growth. However, the combination of low unemployment and reasonable wage growth are likely a positive scenario for the economy. Many people who want jobs have them, but inflation should remain under control.[12]

As the bull market lumbers toward its 9th year, many reports continue to indicate a solid economy.[13] If the economic expansion continues through July 2019, it would be the longest in history (with records going back to the 1850s).[14] While that accomplishment would be noteworthy, our focus remains on current circumstances, and striving to find insight that affects your financial future. From trade to jobs to manufacturing and beyond, we have many details to watch on your behalf.

ECONOMIC CALENDAR

Tuesday: JOLTS

Thursday: Consumer Price Index, Jobless Claims

Friday: Consumer Sentiment

[dt_divider style=”thick” /]

[dt_divider style=”thick” /]

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Investment advisory services and insurance services are provided through The Retirement Solution Inc., a Registered Investment Advisor.

Any economic and/or performance information cited is historical and not indicative of future results. The Retirement Solution Inc. is an investment advisor registered in each state The Retirement Solution Inc. maintains client relationships.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative,

Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[3] http://performance.morningstar.com/Performance/index-c/performance-return.action?t=@CCO

[4] www.msci.com/end-of-day-data-search

[6] www.cnbc.com/2018/05/04/us-stock-futures-dow-earnings-trade-talks-and-nonfarms-on-the-agenda.html

[8] www.usnews.com/news/articles/2018-05-04/unemployment-hits-lowest-level-since-2000

[9] www.cnbc.com/2018/05/04/us-stock-futures-dow-earnings-trade-talks-and-nonfarms-on-the-agenda.html

[11] www.usnews.com/news/articles/2018-05-04/unemployment-hits-lowest-level-since-2000