Retirement age plays a significant role in determining the benefits you’ll receive during your retirement years. Understanding how your retirement age affects benefits is crucial for making informed decisions about when to retire.

In this blog post, we’ll explore the implications of retirement age on benefits and provide valuable insights to help you plan for retirement.

How Retirement Age Can Affect Benefits

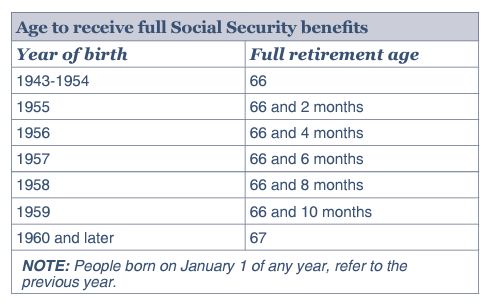

- Social Security Benefits: Your retirement age directly impacts the amount of Social Security benefits you’ll receive. While you can start receiving benefits as early as age 62, your benefit amount will be reduced if you claim benefits before your full retirement age (FRA), which is typically between 66 and 67, depending on your birth year. Conversely, delaying benefits past your FRA can result in increased monthly payments.

- Medicare Eligibility: Retirement age also affects your eligibility for Medicare, the federal health insurance program for individuals aged 65 and older. Enrolling in Medicare at age 65 ensures you have access to essential healthcare coverage, including hospital insurance (Part A) and medical insurance (Part B), as well as prescription drug coverage (Part D) and supplemental coverage (Medigap).

- Pension Benefits: If you have a pension through your employer or another source, your retirement age may impact the timing and amount of pension benefits you receive. Some pension plans offer incentives for retiring early, while others provide higher benefits for delaying retirement.

Understanding the Trade-offs

While retiring early may offer more leisure time and flexibility, it often comes with trade-offs in terms of reduced benefits and increased financial risks:

- Reduced Social Security Benefits: Claiming Social Security benefits before your FRA can result in permanently reduced monthly payments, which may impact your overall retirement income.

- Longer Retirement Period: Retiring early means potentially spending more years in retirement, which requires careful planning to ensure your savings last throughout your lifetime.

- Healthcare Costs: Early retirees may need to secure alternative healthcare coverage before becoming eligible for Medicare at age 65, which can add to retirement expenses.

Planning for Retirement

- Use Retirement Calculators: Utilize retirement calculators, such as our Retirement Nest Egg Calculator, Retirement Savings Calculator, and Retirement Compounding Calculator, to estimate your retirement needs, savings goals, and investment strategies based on different retirement ages.

- Consider the Long-Term Impact: Evaluate the long-term implications of retiring early or late on your financial security, healthcare coverage, and overall retirement lifestyle.

- Consult with a Financial Advisor: Seek guidance from a qualified financial advisor who can help you assess your retirement goals, analyze your financial situation, and develop a personalized retirement plan tailored to your needs and objectives.

Conclusion

Your retirement age can have a significant impact on the benefits you’ll receive during retirement. By understanding how retirement age affects Social Security benefits, Medicare eligibility, and pension benefits, you can make informed decisions about when to retire and plan for a financially secure future.

If you need assistance navigating the complexities of retirement planning, schedule a free call at The Retirement Solution. Our team of financial planners, specialized in retirement planning, are here to help you achieve your retirement goals and enjoy a fulfilling retirement journey.

Investment advisory services and insurance services are provided through The Retirement Solution LLC, a Registered Investment Advisor.

The general views outlined in this material are those of The Retirement Solution LLC and should not be construed as individualized or personalized investment advice. The information presented is for educational purposes only developed from sources believed to be providing accurate information. It is not intended to make an offer or solicitation for the sale or purchase of any specific products, services, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Insurance and Annuity product guarantees are subject to the claims-paying ability of the issuing company. To comply with IRS Regulations, we are informing you of the following: Any discussion or advice regarding tax issues contained in this video presentation was not intended or written to be used, and cannot be used, to avoid taxpayer penalties. Anyone viewing this presentation or contemplating a transaction discussed in this material should seek advice based on your circumstances from an independent tax advisor. Information is not intended to provide specific legal or tax advice.

The information in this material is not intended as tax or legal advice. Be sure to first consult with a qualified financial adviser, tax professional, or attorney before implementing any strategy or recommendation discussed.