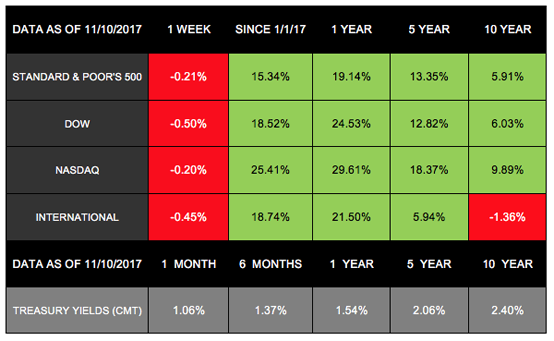

After posting gains every week since September, U.S. stocks declined by market’s close on Friday. The S&P 500 and Dow ended their longest stretch of weekly increases since 2013, and the NASDAQ ended its own 6-week streak.[1] By November 10, the S&P 500 declined 0.21%, the Dow was down 0.50%, and the NASDAQ slipped 0.20%.[2] Meanwhile, the MSCI EAFE dropped by 0.45%.[3]

While these declines are not huge, understanding why stocks dropped after several weeks of steady gains is important. The markets are incredibly complex, so we cannot point to one single detail that drove their performance. We can, however, help you gain insight into what influenced investors’ decisions.The Market’s Drop in Context.

The Market’s Drop in Context

In many ways, uncertainty is to blame for last week’s losses, from a variety of angles:

- Healthcare: Equities dropped as companies continue to analyze changing dynamics in the industry, including potential competition from the tech world. Developments on medical devices and healthcare equipment could create quicker distribution models while decreasing costs, threatening traditional business practices.[4]

- Energy: Tension between Iran, Saudi Arabia, and Lebanon – and the accompanying geopolitical uncertainty – contributed to crude oil prices slipping, which led Energy stocks to lose ground.[5]

- Tax Reform: On Thursday, November 9, the Senate released its tax-reform proposal, which includes significant differences from the current House bill.[6] In particular, the Senate’s decision to delay corporate-tax reductions until 2019 led to a stock sell-off. This change from the House bill also fueled concern about the likelihood of fiscal reform moving forward at all.[7]

[dt_gap height=”10″ /]

What Lies Ahead

No one knows exactly when or how taxes may change – and who will experience the greatest impact. For tax reform to occur, the House and Senate will have to work through the number of places where their plans diverge and align their political priorities.[8] At the same time, the Federal Reserve could raise interest rates as many as 4 times over the next year, which could also alter the financial landscape.[9]In the coming weeks, we will gain more information on tax reform and monetary policy. As we digest information, we will continue focusing on how current circumstances affect clients’ long-term goals. As always, if you have questions about your financial life, contact us anytime.

[dt_gap height=”10″ /

]ECONOMIC CALENDAR

Tuesday: PPI-FD

Wednesday: Consumer Price Index, Retail Sales, Business Inventories

Thursday: Industrial Production, Housing Market Index

Friday: Housing Starts

[dt_divider style=”thick” /]

[dt_divider style=”thick” /]

[dt_divider style=”thick” /]

Notes: All index returns (except S&P 500) exclude reinvested dividends, and the 5- year and 10-year returns are annualized. The total returns for the S&P 500 assume reinvestment of dividends on the last day of the month. This may account for differences between the index returns published on Morningstar.com and the index returns published elsewhere. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

[dt_gap height=”10″ /]

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Investment advisory services and insurance services are provided through The Retirement Solution Inc. a Registered Investment Advisor.

Any economic and/or performance information cited is historical and not indicative of future results. The Retirement Solution Inc. is an investment advisor registered in each state The Retirement Solution Inc. maintains client relationships.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia and Southeast Asia.

The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.[dt_gap height=”10″ /]

- https://www.cnbc.com/2017/11/10/us-stocks-tax-reform-nvidia-earnings.html

- http://performance.morningstar.com/Performance/index-c/performance-return.action?t=SPX®ion=usa&culture=en-US, http://performance.morningstar.com/Performance/index-c/performance-return.action?t=!DJI®ion=usa&culture=en-US, http://performance.morningstar.com/Performance/index-c/performance-return.action?t=@CCO

- https://www.msci.com/end-of-day-data-search

- www.bloomberg.com/news/articles/2017-11-09/asia-stocks-brace-for-volatility-as-dollar-falls-markets-wrap, www.usnews.com/news/business/articles/2017-11-10/most-asian-shares-track-wall-street-losses-on-us-tax-fears

- www.bloomberg.com/news/articles/2017-11-09/asia-stocks-brace-for-volatility-as-dollar-falls-markets-wrap, www.bloomberg.com/news/articles/2017-11-10/lebanon-demands-prime-minister-hariri-s-return-from-saudi-arabia

- www.npr.org/2017/11/09/563095268/gop-senators-unveil-competing-tax-overhaul

- www.bloomberg.com/news/articles/2017-11-09/asia-stocks-brace-for-volatility-as-dollar-falls-markets-wrap

- www.nytimes.com/2017/11/09/us/politics/tax-plan-house-senate-differences.html

- www.bloomberg.com/news/articles/2017-11-09/asia-stocks-brace-for-volatility-as-dollar-falls-markets-wrap