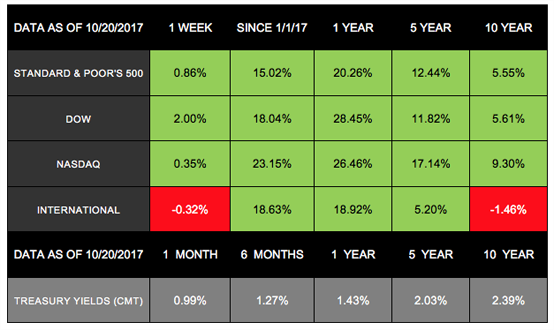

Last week, all 3 major U.S. markets hit record highs once again.[1] The Dow added 2.00% to notch both intraday and closing records, the S&P 500 rose 0.86%, and the NASDAQ gained 0.35%.[2] International stocks in the MSCI EAFE dipped by 0.32% for the week.[3]

On Thursday evening, the senate passed the blueprint for a $4 trillion budget.[4] The vote sets the stage for a tax overhaul that could lower taxes for many families and businesses.[5] In addition, some investors believe the promise of tax cuts could push market valuations even higher.[6]

Other investors, however, have expressed concern about the continuing market highs. Although the economy is growing and corporate earnings are up, they fear a potential market correction.[7]

Against this backdrop, last week marked a key milestone in financial history: the 30th anniversary of Black Monday, the largest single-day market percentage drop in history. Remembering the over 22% loss the Dow experienced that day, some investors may worry about whether the same type of precipitous drop is possible today.[8]

Why Today Is Different

In the wake of the 1987 crash, regulators implemented a series of “circuit breakers” to avoid anxiety-induced sell-offs.[9] These rules required a pause in trading if the Dow dropped by 10, 20, or 30%. Since implementing the circuit breakers, only one market-wide pause has occurred in 1997.[10]

Over the years, regulators have updated the circuit breakers and connected them to S&P 500 performance rather than the Dow. But their function remains the same: to allow time to help understand and react coolly to dramatic market declines. These rules help prevent unnecessary fear and instability from taking over the markets.[11]

Putting Performance in Perspective

While the recent market performance is impressive, it is not unprecedented. Hitting record highs doesn’t have to mean that a correction is ahead. In fact, a year after reaching a new peak, the S&P 500 has had positive growth 72% of the time. Rather than allowing fear or euphoria to drive choices, focusing on data and strategy remains important in every market.[12]

Looking ahead, this week will give us a clearer picture of our economic growth as the first readings of third quarter GDP come out on Friday.[13] Many economists are predicting that the data will show another quarter of strong growth.[14]

We encourage you to contact us if you have any questions about how market highs may affect your portfolio or long-term strategy. We are here to focus on your financial goals and investments, so you can focus on what truly matters to you.

ECONOMIC CALENDAR

Tuesday: PMI Composite Flash

Wednesday: Durable Goods Orders, FHFA House Price Index, New Home Sales

Thursday: Jobless Claims, Pending Home Sales Index

Friday: GDP, Consumer Sentiment

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The Dow Jones Corporate Bond Index is a 96-bond index designed to represent the market performance, on a total-return basis, of investment-grade bonds issued by leading U.S. companies. Bonds are equally weighted by maturity cell, industry sector, and the overall index.

The S&P US Investment Grade Corporate Bond Index contains US- and foreign issued investment grade corporate bonds denominated in US dollars. The SPUSCIG launched on April 9, 2013. All information for an index prior to its launch date is back teased, based on the methodology that was in effect on the launch date. Back-tested performance, which is hypothetical and not actual performance, is subject to inherent limitations because it reflects application of an Index methodology and selection of index constituents in hindsight. No theoretical approach can take into account all of the factors in the markets in general and the impact of decisions that might have been made during the actual operation of an index. Actual returns may differ from, and be lower than, back tested returns.

The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

- http://www.cnbc.com

- http://performance.morningstar.com/

http://www.cnbc.com

http://performance.morningstar.com/

http://performance.morningstar.com/ - http://www.msci.com

- http://www.cnbc.com

- http://www.cnbc.com

- http://www.forbes.com

- http://finance.yahoo.com

- http://www.npr.org/

- http://www.npr.org/

- http://finance.yahoo.com

- http://finance.yahoo.com

- http://www.bloomberg.com

- http://wsj-us.econoday.com/

http://wsj-us.econoday.com/ - http://finance.yahoo.com